EVERGRANDE STATISTICS & FACTS FOR 2022: TOO BIG TO FAIL?

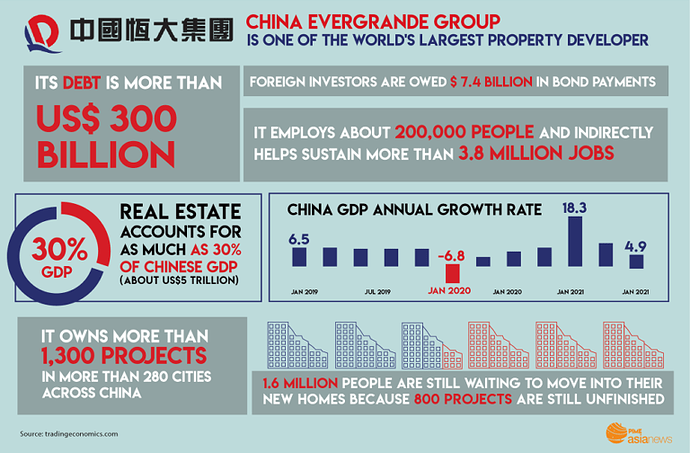

Some analysts out there are worried that it could be China’s Lehman Brothers’ moment, which means that it could have a severe impact on the world’s second-largest economy.

The latest news is that Evergrande has failed to pay bond repayments, and as a result, they have declared default overnight.

What’s interesting about this move is that they are not the only company to do this in the Chinese real estate sector. Kaisa, a much smaller real estate firm, has defaulted on $400 million worth of bonds.

Evergrande was given a month of grace period to make payments, but last week, a filing made to the Hong Kong Stock Exchange said that creditors had demanded their debt be paid off roughly $260 million.

Evergrande statistics showed that it missed its Monday deadline to repay bond coupons that totaled $82 million. They didn’t respond to a request for comment on these coupon payments.

As a result, their shares decreased to a new low, closing down 20% at 1.81 Hong Kong dollars.

This means that their stocks are worth as little as they were when they were first listed in Hong Kong in 2009, which means that they have lost 80% of their value since the beginning of the year.

It appears as if the Chinese government wants to step in and intervene.

Over the last few days, The People’s Bank of China has put some cash into the financial system, hoping that this will settle some people’s nerves.

On Tuesday, it added approximately $15.5 billion to keep liquidity going.

The central bank also promised to keep the real estate market developing at a healthy rate and safeguard the interests of housing consumers and fundamental rights.

On Wednesday, it met with regulators, where authorities reassured individuals that they didn’t want to use real estate as a temporary tool for economic stimulus.

Authorities encourage the financial sector to focus on stabilizing housing prices and land, recommending that companies work with local governments to maintain the healthy development of the real estate industry.

Authorities are watching closely to see what’s going to happen.

The coming days and weeks will be significant. So far, it has failed to address the two interest payments on bonds over the last week publicly.

https://earthweb.com/evergrande-statistics/

Florida’s Senators Want Answers From SEC Chairman on China Evergrande Group

Florida’s two U.S. senators–Republicans Marco Rubio and Rick Scott–joined U.S. Sen. Todd Young, R-Ind., and colleagues sent a letter to U.S. Securities and Exchange Commission Chairman Gary Gensler stressing the risks that the China **China Evergrande Group’**s default and Chinese businesses’ financial and accounting practices pose to U.S. investors.

The letter also calls for enhanced risk disclosures and due diligence from registered investment funds when considering investments in China.

Other signers include U.S. Sens Mike Braun, R-Ind., and Ted Cruz, R-Tex.

The letter is below.

Dear Chairman Gensler,

We write to express concern regarding the investment and accounting methods used by China Evergrande Group, an investment holding company, and the risks such practices may pose to U.S. investors. In the interest of U.S. capital markets, the Holding Foreign Companies Accountable Act (P.L. 116-222) was a much-needed step to safeguard against Chinese-based entities engaging in non-transparent business practices. But as the Evergrande default further demonstrates, the risks to U.S. investors from certain Chinese business practices extend beyond traditional auditing disclosures.

As you know, Evergrande is a large real estate developer with more than $300 billion in liabilities, including nearly $20 billion in U.S. dollar-denominated bonds. For years, U.S. investors have invested in the company, through both debt and equity markets. In December, U.S. ratings agencies assessed Evergrande to be in default after it failed to make coupon payments on its U.S. dollar-denominated bonds, even after an extended grace period. This followed months of uncertainty due to the company’s lack of disclosures regarding its bond payments and questions regarding possible intervention by the central government of China.

Evergrande appears to have engaged in dubious financial and accounting practices including 1) listing unbuilt and unsold properties as assets, 2) overcapitalizing interest payments, 3) collateralizing new loans with previously financed deals, and 4) using complex overseas structures, many tied personally to the CEO and his family, to obscure the extent of the company’s liabilities. Unsurprisingly, Evergrande is not alone and is one of several China-based companies engaged in deceitful practices, as exemplified by Luckin Coffee, TAL Education Group, and HNA Group, to name a few recent examples.

In the case of Evergrande, risks to American investors stem not only from its legal structure, but also from its underlying business practices and China’s arbitrary actions. Of growing concern too is the overall quality of auditing since China began aggressively assuming control of Hong Kong. In June 2021, Hong Kong’s own Financial Reporting Council noted that nearly three quarters of audits reviewed were below standards, and more than 80 percent of inspected audits showed “inadequate skepticism” of underlying assumptions. We are concerned that even international auditing firms now face growing political pressure in Hong Kong and China that could potentially further undermine the transparency of Chinese business practices.

While China Evergrande Group was not directly listed in the U.S., its shares were traded via American Depositary Receipts using a variable interest entity (VIE) structure, enabling the company to take advantage of U.S. investors and capital. We applaud the Security and Exchange Commission’s Investor Bulletin from September 20, 2021 highlighting risks associated with investing in VIEs, but we are concerned the Commission is not doing enough to protect U.S. investors from fraudulent or politically motivated actions of Chinese companies.

Florida’s Senators Want Answers From SEC Chairman on China Evergrande Group - Florida Daily