“Give me control over a nations currency, and I care not who makes its laws” – Baron M.A. Rothschild

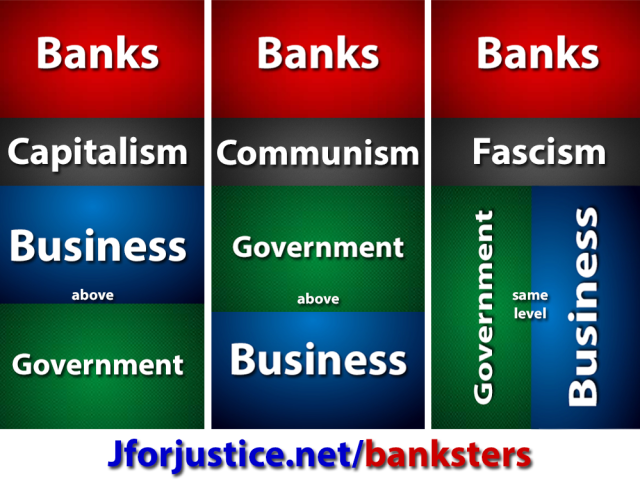

An increasing number of people are waking up to the fact that 99% of the Earth’s population is controlled by an elite 1% – but did you know that one family, the Rothschilds, rule everything, even that elite 1%? Behind the scenes the Rothschild dynasty is unquestionably the most powerful bloodline on Earth and their estimated wealth is around $500 trillion.

Revealed Eye –

Here is a complete list of all Rothschild owned and controlled banks. The U.S. entries might surprise you.

Afghanistan: Bank of Afghanistan

Albania: Bank of Albania

Algeria: Bank of Algeria

Argentina: Central Bank of Argentina

Armenia: Central Bank of Armenia

Aruba: Central Bank of Aruba

Australia: Reserve Bank of Australia

Austria: Austrian National Bank

Azerbaijan: Central Bank of Azerbaijan Republic

Bahamas: Central Bank of The Bahamas

Bahrain: Central Bank of Bahrain

Bangladesh: Bangladesh Bank

Barbados: Central Bank of Barbados

Belarus: National Bank of the Republic of Belarus

Belgium: National Bank of Belgium

Belize: Central Bank of Belize

Benin: Central Bank of West African States (BCEAO)

Bermuda: Bermuda Monetary Authority

Bhutan: Royal Monetary Authority of Bhutan

Bolivia: Central Bank of Bolivia

Bosnia: Central Bank of Bosnia and Herzegovina

Botswana: Bank of Botswana

Brazil: Central Bank of Brazil

Bulgaria: Bulgarian National Bank

Burkina Faso: Central Bank of West African States (BCEAO)

Burundi: Bank of the Republic of Burundi

Cambodia: National Bank of Cambodia

Came Roon: Bank of Central African States

Canada: Bank of Canada – Banque du Canada

Cayman Islands: Cayman Islands Monetary Authority

Central African Republic: Bank of Central African States

Chad: Bank of Central African States

Chile: Central Bank of Chile

China: The People’s Bank of China

Colombia: Bank of the Republic

Comoros: Central Bank of Comoros

Congo: Bank of Central African States

Costa Rica: Central Bank of Costa Rica

Côte d’Ivoire: Central Bank of West African States (BCEAO)

Croatia: Croatian National Bank

Cuba: Central Bank of Cuba

Cyprus: Central Bank of Cyprus

Czech Republic: Czech National Bank

Denmark: National Bank of Denmark

Dominican Republic: Central Bank of the Dominican Republic

East Caribbean area: Eastern Caribbean Central Bank

Ecuador: Central Bank of Ecuador

Egypt: Central Bank of Egypt

El Salvador: Central Reserve Bank of El Salvador

Equatorial Guinea: Bank of Central African States

Estonia: Bank of Estonia

Ethiopia: National Bank of Ethiopia

European Union: European Central Bank

Fiji: Reserve Bank of Fiji

Finland: Bank of Finland

France: Bank of France

Gabon: Bank of Central African States

The Gambia: Central Bank of The Gambia

Georgia: National Bank of Georgia

Germany: Deutsche Bundesbank

Ghana: Bank of Ghana

Greece: Bank of Greece

Guatemala: Bank of Guatemala

Guinea Bissau: Central Bank of West African States (BCEAO)

Guyana: Bank of Guyana

Haiti: Central Bank of Haiti

Honduras: Central Bank of Honduras

Hong Kong: Hong Kong Monetary Authority

Hungary: Magyar Nemzeti Bank

Iceland: Central Bank of Iceland

India: Reserve Bank of India

Indonesia: Bank Indonesia

Iran: The Central Bank of the Islamic Republic of Iran

Iraq: Central Bank of Iraq

Ireland: Central Bank and Financial Services Authority of Ireland

Israel: Bank of Israel

Italy: Bank of Italy

Jamaica: Bank of Jamaica

Japan: Bank of Japan

Jordan: Central Bank of Jordan

Kazakhstan: National Bank of Kazakhstan

Kenya: Central Bank of Kenya

Korea: Bank of Korea

Kuwait: Central Bank of Kuwait

Kyrgyzstan: National Bank of the Kyrgyz Republic

Latvia: Bank of Latvia

Lebanon: Central Bank of Lebanon

Lesotho: Central Bank of Lesotho

Libya: Central Bank of Libya (Their most recent conquest)

Uruguay: Central Bank of Uruguay

Lithuania: Bank of Lithuania

Luxembourg: Central Bank of Luxembourg

Macao: Monetary Authority of Macao

Macedonia: National Bank of the Republic of Macedonia

Madagascar: Central Bank of Madagascar

Malawi: Reserve Bank of Malawi

Malaysia: Central Bank of Malaysia

Mali: Central Bank of West African States (BCEAO)

Malta: Central Bank of Malta

Mauritius: Bank of Mauritius

Mexico: Bank of Mexico

Moldova: National Bank of Moldova

Mongolia: Bank of Mongolia

Montenegro: Central Bank of Montenegro

Morocco: Bank of Morocco

Mozambique: Bank of Mozambique

Namibia: Bank of Namibia

Nepal: Central Bank of Nepal

Netherlands: Netherlands Bank

Netherlands Antilles: Bank of the Netherlands Antilles

New Zealand: Reserve Bank of New Zealand

Nicaragua: Central Bank of Nicaragua

Niger: Central Bank of West African States (BCEAO)

Nigeria: Central Bank of Nigeria

Norway: Central Bank of Norway

Oman: Central Bank of Oman

Pakistan: State Bank of Pakistan

Papua New Guinea: Bank of Papua New Guinea

Paraguay: Central Bank of Paraguay

Peru: Central Reserve Bank of Peru

Philip Pines: Bangko Sentral ng Pilipinas

Poland: National Bank of Poland

Portugal: Bank of Portugal

Qatar: Qatar Central Bank

Romania: National Bank of Romania

Rwanda: National Bank of Rwanda

San Marino: Central Bank of the Republic of San Marino

Samoa: Central Bank of Samoa

Saudi Arabia: Saudi Arabian Monetary Agency

Senegal: Central Bank of West African States (BCEAO)

Serbia: National Bank of Serbia

Seychelles: Central Bank of Seychelles

Sierra Leone: Bank of Sierra Leone

Singapore: Monetary Authority of Singapore

Slovakia: National Bank of Slovakia

Slovenia: Bank of Slovenia

Solomon Islands: Central Bank of Solomon Islands

South Africa: South African Reserve Bank

Spain: Bank of Spain

Sri Lanka: Central Bank of Sri Lanka

Sudan: Bank of Sudan

Surinam: Central Bank of Suriname

Swaziland: The Central Bank of Swaziland

Sweden: Sveriges Riksbank

Switzerland: Swiss National Bank

Tajikistan: National Bank of Tajikistan

Tanzania: Bank of Tanzania

Thailand: Bank of Thailand

Togo: Central Bank of West African States (BCEAO)

Tonga: National Reserve Bank of Tonga

Trinidad and Tobago: Central Bank of Trinidad and Tobago

Tunisia: Central Bank of Tunisia

Turkey: Central Bank of the Republic of Turkey

Uganda: Bank of Uganda

Ukraine: National Bank of Ukraine

United Arab Emirates: Central Bank of United Arab Emirates

United Kingdom: Bank of England

United States: Federal Reserve, Federal Reserve Bank of New York

Vanuatu: Reserve Bank of Vanuatu

Venezuela: Central Bank of Venezuela

Vietnam: The State Bank of Vietnam

Yemen: Central Bank of Yemen

Zambia: Bank of Zambia

Zimbabwe: Reserve Bank of Zimbabwe

In 1835, US President Andrew Jackson declared his disdain for the international bankers:

“You are a den of vipers. I intend to rout you out, and by the Eternal God I will rout you out. If the people only understood the rank injustice of our money and banking system, there would be a revolution before morning.”

The Economic Hitmen -

The Economic Hitmen

Related -

-

The Rothschild Conspiracy Explained in 4 Minutes -

The Rothschild Conspiracy Explained in 4 Minutes

On DG:

How Banksters Rule The World – Bank of England Owns Third of UK Debt

How Banksters Rule The World – Bank of England Owns Third of UK Debt

How Banksters Rule The World – European Bank for Reconstruction and Development (EBRD)

How Banksters Rule The World – Shifting from Central Planning to a Decentralised Economy

How Banksters Rule The World – A DIGITAL EURO