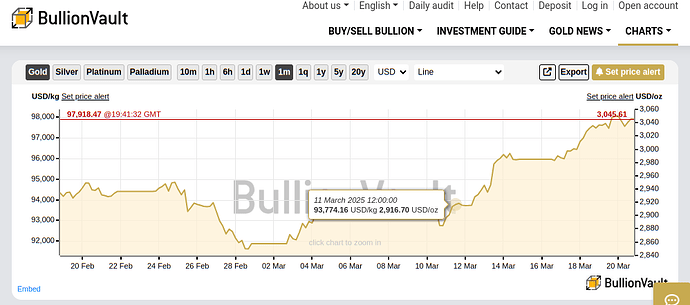

Click the link below for Gold and Silver spot price charts:

Gold usually escapes danger when war looms. Could gold be going to America because the Western "leaders" in Europe are going to pick a fight with Russia?

T.H.E.Y. need a war in order to initiate their "Great Reset" and try to escape justice for their C-19 Genocide.

He says in the video below that there will be no cash in 2 years.

Maria Zeee & Dr. Kirk Elliott: It’s Happening: We Are Getting A New Financial System

Silver Wars - US Designates Silver As Critical Mineral

The US has designated silver as a new addition to it's "List Of Critical Minerals". This growing recognition of silver as a key strategic asset is just beginning, and it's no surprise that we appear to be on the verge of military conflict in the region of the world's largest silver producer. Source: Smart Silver Stacker.

Demand For Silver & Gold Hits All-Time Highs As Supply Of Silver Dwindles To Almost Nothing!

For The First Time, Morgan Stanley Has Moved 20% Of Their Investments Into Gold As Experts Predict The Mother Of All Bear Markets Has Just Begun.

He Nailed $4,000 Gold Call, Now He Says $7,000 Gold, $100 Silver Are Next

“Gold at $7,000 and silver at $100,” predicts Frank Holmes, CEO of U.S. Global Investors and one of the first to call $4,000 gold back in 2020—a forecast now nearly fulfilled with gold already surging past $3,700. Holmes warns that ballooning global debt, record-breaking military spending, and a Federal Reserve trapped in a policy bind are setting the stage for an explosive metals rally. Holmes points to a world fracturing under cyberattacks, escalating conflicts, and a new era of “sovereign data” and protectionism, where hard assets become the ultimate defense against currency devaluation.

China Plans 4 New Gold Hubs as it Moves Forward With Global Reset

“The global financial order is tilting—and it’s not going to stop,” says Dr. Nomi Prins, former Goldman Sachs managing director and bestselling author of Collusion.

With the Shanghai Gold Exchange launching offshore vaults in Hong Kong, Singapore, Zurich, and Dubai, Prins calls it a “time zone tilt, a geographical tilt, a power tilt” that shifts gold—and power—away from the West.

“This is about redistricting the globe around the hard currency of gold,” she explains. “Central banks are diversifying away from the dollar, and gold is now the second most held reserve asset worldwide, ahead of the euro. China has been carefully sequencing this strategy for over a decade.”

As gold surges toward $4,500 and silver gains momentum, Prins sees the East tightening its grip: “More nations are moving their gold away from London and into Shanghai or Singapore. That takes supply off the market, lifts prices higher, and creates an entirely new power base.”

Chapters:

00:00 – China’s bold gold move

03:04 – Why new offshore vaults matter

05:38 – Inside China’s decade-long gold strategy

07:30 – The de-dollarization push

09:30 – Can China dethrone the LBMA?

12:38 – Gold’s next target: $4,500+

13:19 – Silver set to soar: $60 in sight

15:08 – Is China on track to overtake global finance?

Paper Silver IMPLODES: Experts Predict HUNDREDS PER OUNCE is Coming

The paper silver game is finally blowing up—and the cracks are spreading fast. For decades, the elites have rigged the silver market with fake paper contracts, suppressing real prices and keeping the truth hidden. But now the system is coming apart in real time. London’s vaults are running dry, lease rates are exploding, and traders are literally airlifting 1,000-ounce bars across the ocean just to keep up. In tonight’s show, I’m breaking down what’s really happening behind the scenes: the physical shortage, the manipulation, and why experts say silver could soon hit hundreds—maybe even thousands—per ounce. This isn’t just another market move. This is the beginning of the end for the paper money empire. - S.H.

Jim Rickards SHOCKS: Gold to $10,000 by 2026 & Silver to $200 – “It's Just Getting

![]() GOLD EXPLODES PAST $4,400 to NEW ALL-TIME HIGHS on Dec 22, 2025 – Jim Rickards Reveals the REAL Reasons (NOT Just the Fed!) In this must-watch pre-Christmas interview, Daniela Cambone sits down with legendary bestselling author and former CIA advisor Jim Rickards on the exact day gold shatters records above $4,400 (heading toward $4,500) and silver charges to near $70 in its best year ever.

GOLD EXPLODES PAST $4,400 to NEW ALL-TIME HIGHS on Dec 22, 2025 – Jim Rickards Reveals the REAL Reasons (NOT Just the Fed!) In this must-watch pre-Christmas interview, Daniela Cambone sits down with legendary bestselling author and former CIA advisor Jim Rickards on the exact day gold shatters records above $4,400 (heading toward $4,500) and silver charges to near $70 in its best year ever.

Gold Warning Issued as New Monetary System Takes Hold

Central banks are buying gold like never before. Wall Street won’t tell you this. The dollar’s value is eroding, and global elites are quietly moving to gold. Don’t wait until it’s too late, ITM has helped thousands build strategies for this exact moment.

GAME OVER: SILVER MARKET: JP Morgan Flips LONG + China Ban Starts

Summary:

JP Morgan inherited a HUGE Silver Debt when they took over and assumed Bear Sterns back in 2008, as Bear Sterns was holding a massive short. Instead of selling, they held on to it as they envisioned they could manipulate the markets with fake fiat money and quietly tell everyone to sell silver, while they maintained the short position and quietly began accumulating. I saw this in the Charts back in 2016, I was telling everyone that the Silver is being quietly accumulated and there is going to be a HUGE Bull Run in the near future. It did take a bit longer than I thought, but it’s running now and I think it’s just getting started. JP Morgan covered their “Short Position” inherited from Bear Sterns, meaning they BOUGHT Silver and they have been accumulating for close to two decades anyway, all while telling everyone else to sell of course. Now they WANT it go up. CHINA, announced it will ban the EXPORTS of Silver beginning in January 2026. This will greatly appreciate the value also. Who Needs Silver? Apple, Telsa, Computer Makers, Car Makers, and any company making Electrical components. JP Morgan is sitting on almost an ENTIRE YEARS Worth of the World’s Silver Production and the mines are going dry. What does mean? It means there is going to be a Physical Silver Shortage. All these corporations that need silver are going to be FORCED to pay much, much higher prices. It means INFLATION is coming. It means demand for Silver will skyrocket. It means this Bull Run of Silver is likely just beginning. You also have Saudi Arabia departing the US Petro Dollar coming soon. Expect the Dollar to go DOWN and commodities like Silver and Oil to go up, which will cause Inflation. This will eventually cause a “Financial Storm” in which an entire new financial system will have to be introduced, which they are calling the “Great Reset.” As mentioned, JP Morgan is sitting on almost one years of the world’s total production of silver. Can you imagine if a company was holding one years worth of the worlds oil production. That is called some major “leverage.” That is called the ability to control your own destiny. It should be illegal, but they have been lying for decades about what they were doing and not much that can be done now.

U.S. Mint Halts Silver Sales as Prices Surge to Record Levels

Publish Date: 14 January 2026 15:03:24

14 Jan 2026

The U.S. Mint has temporarily halted sales of its collectible silver coins and medals, citing sharp price increases and extreme volatility in the silver market. These products, commonly referred to as numismatic items, differ from bullion in that they carry added collectible and historical value rather than being sold purely for metal content.

An official notice sent to customers on January 12, 2026, shows that the Mint is reassessing not only pricing, but also its broader sales and supply strategy. The timing reflects mounting pressure from rapidly rising production costs.

A Price Shock That Left Little Room to Maneuver

Silver prices have surged aggressively, with spot prices climbing above the $88 [Jan 15 update: $95] per ounce level and pushing into uncharted territory. According to the Mint, this sudden escalation has made existing retail prices unsustainable, forcing a temporary pause while new pricing structures are evaluated.

This kind of move is not unfamiliar to long-time collectors. Historically, when silver prices accelerate too quickly, the Mint tends to pull products from sale and return with updated pricing. This time, however, the speed and magnitude of the move appear to have shortened the response window.

Flagship Series Caught in the Middle

Popular releases such as the American Silver Eagle now sit at the center of uncertainty. The Mint warned that certain products may be removed entirely from its website until repricing is finalized.

Meanwhile, prices in the secondary market are already testing the $100 range, creating a widening gap between official issue prices and real-world trading levels. That imbalance has increased arbitrage pressure and drawn in short-term speculative demand alongside traditional collectors.

Subscription Programs Face Adjustments

The suspension also extends beyond one-off purchases. The Mint confirmed that active subscription programs may be affected by upcoming price changes, advising customers to review their payment methods in advance.

While framed as a procedural notice, the language suggests deeper recalibration. Automatic fulfillment models become difficult to maintain when input costs fluctuate this sharply, raising questions about longer-term pricing stability for collectors.

Supply Constraints Add Another Layer of Stress

Market chatter indicates the issue is not purely about pricing. Tight availability of silver planchets — the blanks used to strike coins — has reportedly slowed production, adding pressure on the supply side.

If silver prices remain elevated, the current suspension could stretch longer than initially anticipated. For now, the Mint says customers will be notified once updated pricing and availability are finalized, leaving the market in a holding pattern.