Target market cap losses swell to $15 billion as shares drop again amid woke backlash

Target Loses over $15 Billion over Sodomite "Pride" Promotion

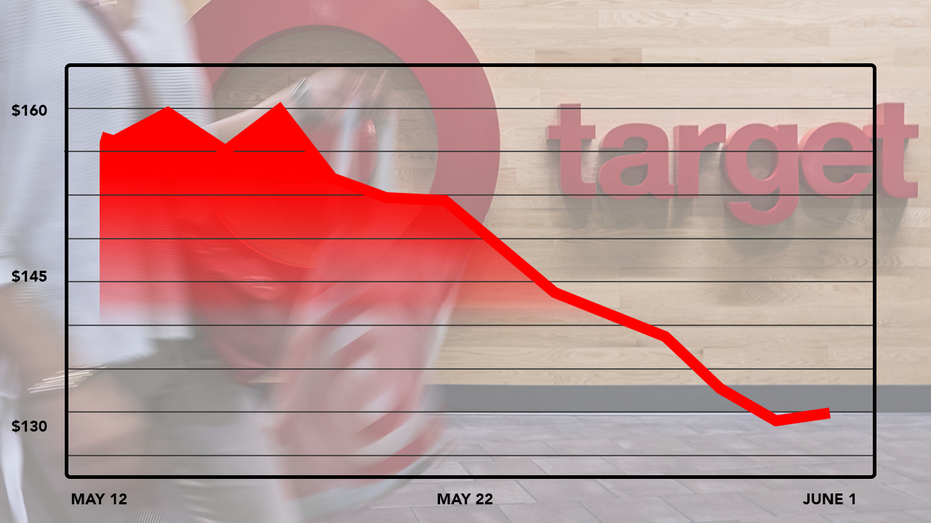

Target shareholders took a beating again on Friday, with the big-box retailer’s stock falling 3.26%. The backlash from the Pride controversy coincides with the stock losing over $15 billion in market value since mid-May.

Shares plummeted to $126.99 when the market closed after eclipsing $161 just last month after a third Wall Street firm downgraded the shares on concerns over slowing sales.

Since the controversy began, Target's market cap has fallen $15 billion to $58.61 billion as of Friday’s closing price. Target’s market value was over $74 billion before the polarizing Pride displays made national news, as tracked by Dow Jones Market Data Group.

TARGET SHARES DOWNGRADED AGAIN ON SALES CONCERNS

Target initially irked conservatives with Pride displays that featured a plethora of controversial items, but outraged the LGBTQ community when the displays were dialed back ahead of Pride Month.

Target initially irked conservatives with Pride displays that featured items such as "tuck-friendly" women's swimsuits, but the LGBTQ community became outraged when the displays were dialed back ahead of Pride Month. The retailer recently suffered nine straight days of losses on the heels of backlash from both sides of the issue and finished the week with another losing streak.

Entering Friday, Target’s stock value had fallen roughly 3.1% in the last five days, after plummeting about 18.5% the last month. Already near a three-year low, Target shares have been hit with a series of downgrades amid the controversy over Pride products.

The company’s latest snub from Citi analyst Paul Lejuez lowers the stock to neutral from buy and pits the troubled retailer against rival Walmart, which Lejuez said in a note on Friday would begin gobbling up market share.

Considering the competitive landscape, "We believe Walmart is likely to continue gaining market share, and Target's high exposure to discretionary sales will not serve them well in the current macro backdrop," Lejuez said in the note.

"Despite the recent stock pressure, we cannot recommend investors buy the stock given these dynamics and now believe the risk, reward is more balanced, but risk is more to the downside near term," he continued.

Lejuez also highlighted Target's 13.9% drop in store traffic the final week in May as inflationary pressures subdued consumer spending over Memorial Day weekend.

Many Target locations across the country feature massive June Pride month displays on an annual basis. (Brian Flood/FOX Business)

Target Pride swimsuits boast "tuck-friendly construction" and "extra crotch coverage," presumably to accommodate male genitalia, even if they are made in an otherwise female style. (Brian Flood/FOX Business / Fox News)

On Monday, KeyBanc Capital Markets cut the retailer's shares to "sector weight" from "overweight" as the resumption of student loan payments stipulated by Congress' debt ceiling agreement poses a sizable headwind for discretionary spending for shoppers, which has an elevated discretionary sales mix and a younger, college-educated core consumer demographic.

Last week, JPMorgan Chase also downgraded Target's stock, with analysts citing the possibility of a decline in sales due to consumers pulling back spending amid persistent inflation.

Last month, Target confirmed "adjustments" to the Pride merchandising plans were underway after Fox News Digital learned it rolled back displays at some of its locations. A Target insider told Fox News Digital that some Southern stores were told by the corporation to move LGBTQ Pride merchandise away from the front of their locations after customer outrage to avoid a "Bud Light situation."