The Bank Crisis - The big Picture . . . Inevitable Collapse . . . less than 1 year?

As the present, ongoing, Bank crisis emerged, many have struggled to see the "big picture" to plan for the future. Well, this is the big picture:

We are in a credit/debt crisis loop.

Banks are undercapitalized. They need more cash as capital, but to get the cash, they need to borrow it. More borrowing causes higher interest rates, which means more debt, for which they will again have to borrow . . . and on and on and on it would go. Until it collapses.

When the government passed out all that free money during the COVID pandemic, that money flowed into bank accounts. With BASEL 3 banking requirements, banks had to have a percentage of Tier 1 assets that could be liquidated pretty darn quick in case the bank needed to raise money fast.

"Tier 1 assets" means government treasuries . . . and at that time, when banks HAD to buy government treasuries to have Tier 1 assets, the yield on those Treasury bonds was pretty much 0.

Now, with the federal reserve raising rates at such a furious pace, all those bonds the Banks bought . . . have lost value. Why would I want to buy your bond yielding almost nothing, when the current 2-year Treasury Bond is yielding 4.10%? A week ago it was 5%.

So the banks can't sell it at face value. They would have to sell the bond at a loss in order to make it sell at all.

Silicon Valley Bank (SVB) did this to raise capital due to the outflows of cash, and took an almost 2 billion dollar loss. This is called "unrealized losses."

As you read this story, the total of unrealized losses in the banking system is 620 billion dollars.

Now, the federal reserve is saying if a Bank needs capital, the Bank can borrow against their Treasury bonds and Mortgage Backed Securities, at "par" (face value) because if they did it mark-to-market, the sale would be a loss and not help at all.

The reason for all the red in the banking sector today is because investors aren't sure who holds a lot of the older bonds and is under-capitalized in case distresses comes along.

Pausing the interest rate hike won't do anything to solve this problem; the only solution is to lower the rates back down until the older bonds could be sold on the open market for pretty much face value.

BUT . . . That would cause rapidly rising inflation as well as a faster flight to de-dollarization by foreign countries, and then we are on the road to hyper-inflation.

Conversely, if they continue to raise the Interest rate . . . well . . . . .the financial collapse would make the great depression look like the roaring 20's. . . . and that would probably be a best case.

So the Banks (and government) are literally trapped by a problem of their own making. They face a choice: Save the Banks OR, save the dollar. They can't do both.

This week, they made their choice: Save the banks.

So from this moment, the Shit is flying through the air and is about to meet the fan.

Some Bankers Are Already Sounding the Alarm

Morgan Stanley, MS, says sell any bounce on this government intervention, next leg of bear market has begun.

On March 2, Morgan Stanley's Mike Wilson gave his thoughts on the current state of the stock market, saying it is now in a "death zone" with predictions of its potentially massive drop. Wilson estimates that the S&P 500 could drop down to 3,000 points within the month, which is a 26% slump.

Wilson said that US stocks have reached "unsustainable heights" and that investors were like climbers who were pushing towards the top without being able to consider the risks properly. The move by investors was likened to "blindly" pushing toward the top of Mount Everest.

Wilson: "Many fatalities in high-altitude mountaineering have been caused by the death zone, either directly through loss of vital functions, or indirectly by wrong decisions made under stress or physical weakening that lead to accidents,"

Morgan Stanley's chief US equity strategist said that the current valuations have much in common with the "death zone," which is Mount Everest's top where oxygen is extremely low. Basically, it meant that it was in the dangerous territory since the "death zone" is where many climbers lost their life.

Wilson: "This is a perfect analogy for where equity investors find themselves today, and quite frankly, where they've been many times over the past decade,"

Year-to-date, the S&P 500 was around 6%, and Nasdaq Composite was up by 13%.

It was also recently reported that the Federal Reserve was unlikely to be able to bring down inflation without increasing interest rates even more, which would cause a recession. This came from Former Fed Governor Frederic Mishkin's research paper.

So the Stock Market does not appear to be the place to be if one is trying to protect wealth - or even earn a profit down the road.

TREASURY MARKET SIGNALING "RECESSION"

The Treasury market is signaling that a recession is all but inevitable if history is any guide. As concerns about the financial health of the US banking sector mount, benchmark yields on every maturity of Treasury — from three-month T-bills to 30-year bonds — have fallen below 4.75%, the upper end of the Federal Reserve’s range for its key benchmark rate.

They have fallen because people view Treasuries as a safe haven and are now flooding the Treasury Bond market with money. Since everyone wants "safety" the Treasury can afford to drop the rate of interest it is willing to pay, because buyers of Treasuries are looking for safety, not necessarily rate of return.

According to Yahoo News, Since 1977, such a move has foreshadowed every economic downturn, according to data compiled by Bloomberg. Its predictive powers were off only once in 1998, when the Fed slashed rates after the collapse of hedge fund Long Term Capital Management but a recession never materialized.

The steep drop in Treasury yields reflects speculation that the failure of Silicon Valley Bank and two other lenders may hasten the end of the Fed’s rate hikes amid concern about spreading contagion. Two-year yields fell 54 basis points Monday, the biggest drop since Black Friday in 1987, when the S&P 500 tumbled 21%.

Big Shots Saying "The End"

https://twitter.com/KimDotcom/status/1615431194002493440

Did you catch his time frame? He wrote ". . . this year."

And actual Money People are saying worse:

https://twitter.com/unusual_whales/status/1635454785699872768

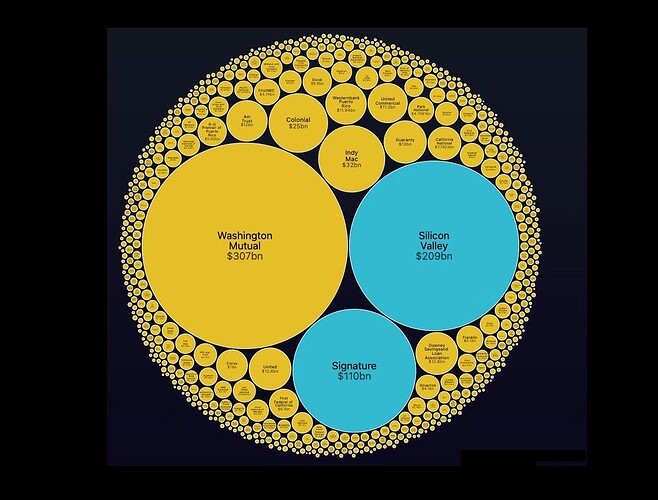

To put this week's events into perspective, take a look at this chart showing the size of ALL Bank Failures since the year 2000:

The 2008 failure of Washington Mutual Bank is what triggered the 2008 Great Financial Crisis, when the $307 Billion dollar bank, failed.

This week, the two banks that failed, Silicon Valley and Signature Banks, are together, BIGGER than Washington Mutual. So that puts into perspective how destructive their failures will prove to be in the days and weeks to come.

This is, without doubt, a financial and economic catastrophe.

The unraveling can happen in an instant.

A week ago, everything was still fine. Then, within a matter of days, SVB’s stock price plunged, depositors pulled their money, and the bank failed. Poof.

The same thing happened with Lehman Brothers in 2008. In fact over the past few years we’ve been subjected to example after example of our entire world changing in an instant.

We all remember that March 2020 was still fairly normal, at least in North America. Within a matter of days people were locked in their homes and life as we knew it had fundamentally changed.

This is going to keep happening.

This is a financial catastrophe, but it’s just getting started. Like Lehman Brothers in 2008, SVB is just the tip of the iceberg. There will be other casualties – not just in banks, but money market funds, insurance companies, and even businesses.

Foreign banks and institutions are also suffering losses on their US government bonds… and that has negative implications on the US dollar’s reserve status.

Think about it: it’s bad enough that the US national debt is outrageously high, that the federal government appears to be a bunch of fools incapable of solving any problem, and that inflation is terrible.

But no one in charge seems to understand any of this.

The guy who shakes hands with thin air insisted this morning that the banking system is safe. Nothing to see here, people.

The Federal Reserve– which is the ringleader of this sad circus– doesn’t seem to understand anything either.

In fact Fed leadership spent all of last week insisting that they were going to keep raising interest rates.

Even after last week’s banking crisis, the Fed probably still hasn’t figured it out. They appear totally out of touch with what’s really happening in the economy. And when they meet again next week, it’s possible they’ll raise rates even higher (and trigger even more unrealized losses).

So this drama is far from over.

WHAT TO DO?

There's an ill-wind blowing and we, (you and me) are on the wrong side of it. What to do?

Many people are saying buy Gold and Silver.

I get why they are saying that. Gold and Silver Bullion are protection for wealth. They store wealth right there inside themselves. Gold and Silver will ALWAYS have a value no matter what means of commerce is in effect. If the US Dollar becomes worthless or is de-monetized as "legal tender" whatever replaces it, will have a price in Gold in Silver. So the holding of Gold and Silver would, necessarily, STORE wealth. I emphasized the word "holding" because if you don't physically HOLD the gold, then you don't own it.

Buying Gold or Silver "on paper" and letting someone ELSE store it for you, makes it "not yours." So if you're going to buy precious metals, you better have them delivered into your hands, because what's not in your hand, is not yours.

Here's the problem with Gold and Silver . . . . government can make owning those metals, "illegal." They did it once with Gold way back under President Roosevelt. They might try doing that again.

So what else can one do to preserve wealth?

Well, I am NOT a licensed financial planner or expert, and so I cannot give financial advice. You should speak with a Licensed financial expert before making any financial decisions.

Having said that, as a layman, and not an expert in any way, I have made the personal decision to put my "dollars" into something which is not "dollars."

Maybe you should too.

Whether it is Real Estate, or precious Gems, or . . . . anything tangible that holds its wealth within itself, is better than holding "dollars."

Sooner or later, those "Dollars" are, in fact, going to become worthless. That is assured now that the government and bankers have done what they've done in this latest banking crisis.

Look to the collapse of the Soviet Union and Venezuela as good indicators of what happened. But remember there will be large difference since this collapse will be larger than any in history.

It's only a matter of time now. And the clock is ticking.