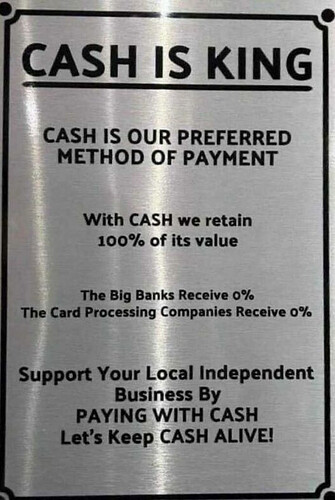

RFK Jr: Plans for ‘Cashless Society’ Are about ‘Control and Oppression’

Frank BergmanJuly 23, 2023

Democrat presidential candidate Robert F. Kennedy Jr. has issued a warning to the public about the global plans to abolish physical cash to create “cashless societies.”

In an interview with The New York Post, RFK Jr., the nephew of President John F. Kennedy, took a deep dive into the topic of currency and the coming “digital cash” era.

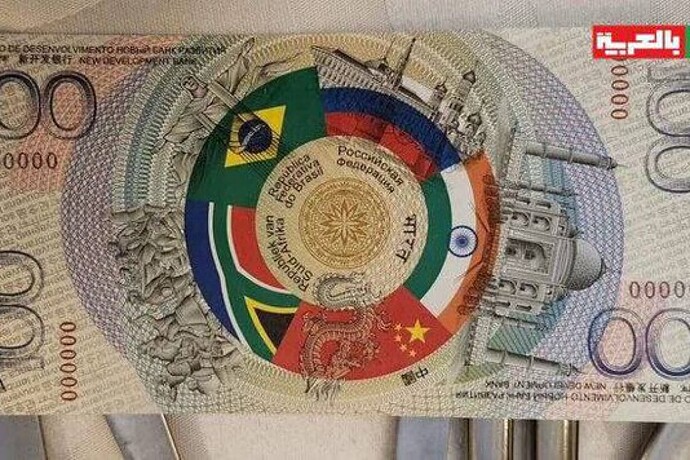

As Slay News previously reported, Democrat President Joe Biden has ordered the Federal Reserve to implement a CBDC that will replace traditional money as a “digital dollar.”

The move from Biden falls in line with the agenda of the World Economic Forum (WEF), the United Nations, the International Monetary Fund (IMF), and other globalist interests.

The WEF has been pushing the technology for some time, gloating that “digital cash” will offer a handful of powerful elites “absolute control” over the world’s populations.

Slay News recently reported on a WEF agent boasting during a globalist summit that one of the “benefits” of “digital cash” is that governments can control what citizens can and can’t pay for.

During the WEF’s recent Annual Meeting of the New Champions in Communist China, Tolani Senior Professor of Trade Policy at Cornell University Eswar Prasad gave a chilling insight into the rationale behind the globalist elite’s interest in pushing toward a cashless society.

Prasad spoke about the coming Central Bank Digital Currencies (CBDCs) and how unelected authoritarians will be able to control the public by managing the regulation of society’s spending.

According to Prasad, a top economics expert and former International Monetary Fund (IMF) official, the coming CBDC-only cashless society will be regulated to ensure that people comply with what is considered to be “desirable.”

Continued at link...