*toughest budget in 34 years likely tomorrow

*Will it deal with deficits and huge debt adequately?

*Inflation will lead to further pay demands in public sector

*Likely introduction of income tax on pensions, increased income tax on individuals and companies, possible capital tax on property speculations, increased duties, fees, and municipal charges

*All will be revealed tomorrow

GIVEAWAY BUDGETS A THING OF THE PAST

It is polite to suggest that the budget tomorrow will be the toughest in 10 years, as the Gibraltar Chronicle hails in its headline. It will likely be the toughest in at least the last 34 years.

What the Chronicle does is smooth the way to the inevitable unpopular financial measures that Fabian Picardo’s GSLP-Liberal Government will be forced to take by the financial reality being faced now.

ENOUGH TO COVER DEFICITS AND DEBT

Yet the question will remain whether the Budget provisions will do enough, not only to deal with current deficits, but also the huge public debt that successive governments have piled on us. It is a debt that has increased recently by the £500 million guaranteed by the UK, with that guarantee expiring in early December 2023.

Ever since Sir Peter Caruana’s GSD Government was first elected in 1996, Budgets have been giveaway ones, and borrowings have been increased to unaffordable amounts. Even Sir Joe Bossano’s ‘wise ‘rainy day’ fund was soon depleted fully by Sir Peter’s GSD Government. Thereafter no government has been careful either about expenditure or borrowing, hence where we are today.

INFLATION PAY DEMANDS

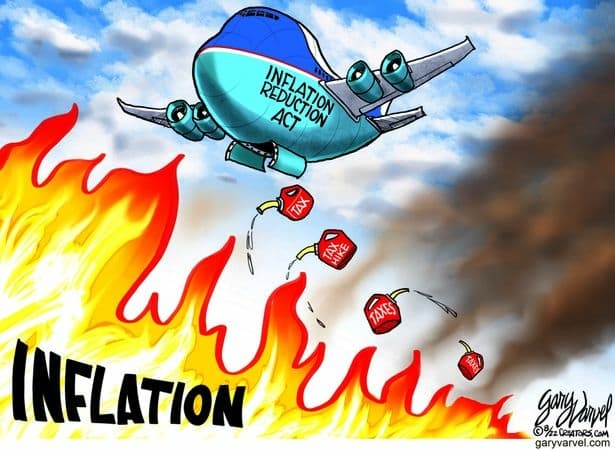

Additionally, we now have the same issues that are prevalent in the UK, namely rising inflation with the inevitable pay increase demands and trade union action, both in the main in Gibraltar currently coming from public sector quarters.

The realities that there is no money available, and that public sector pay is about 30-40% higher than in the UK will have little or no bearing on preventing the call for increase to meet inflation. The demand for more will be there for all to see, irrespective of affordability.

WHOSE FAULT?

The GSLP-Liberal Government point the finger of fault at public finances having been hit by and debt having needed to be increased due to Covid-19 and Brexit uncertainty.

Those are both realities, but, as the GSD point out, the impact has been made much worse by bad financial management and hugely increased public borrowing, both being the fault of the GSLP-Liberal Government.

To make matters worse we are also now faced with the adverse economic effects caused by Gibraltar being placed on the ‘grey list’ by the Financial Action Task Force, which will have unwanted unfavourable consequences on public revenues.

The fact remains that whilst the GSLP-Liberal Alliance have been in government no measures have been put in place to safeguard Gibraltar against harmful events reducing public revenues.

WHAT WILL THE BUDGET BRING?

Nothing is yet in the public domain about what the budget measures will be, but monies are needed by the government to pay its way. There are not many avenues open to it. It can increase what there is, bring those who are not taxed into the tax net and/or it can introduce new revenue raising measures.

Currently pensioners earning big pensions are not paying tax, which makes many of them better off than when they were in employment. That cannot be right, or fair to those working for a living. Income tax will likely be charged on pensions that exceed the tax-free allowance, and other allowances, applied to all payers of income tax.

The likelihood is also that income tax will go up for higher earners, but that does not mean the rich. For reasonable amounts to be raised, those increases must penetrate much of society, except the truly low earners. An increase on income tax payable by companies seems inevitable also.

It may be that a new capital tax will be charged on real properties that are not first homes. The reality is that the over-heated property market needs to be calmed down. Taxing it will not only raise revenue, but will also dampen down speculation, which is currently widespread.

Care must be taken, however, that any such capital tax should not be retrospective. It would need to be imposed on increases in value accrued after the measure is introduced.

We have already seen the imposition of new charges, prescription charges are an example, the likelihood is that more new charges may be found, but certainly increases on current fees and import duties are likely, especially to ease the way into the Gibexit deal.

Finally, the world-wide increase in fuel costs justifies increased electricity and water charges. It may be that those increases will not raise revenue, but any needed subsidisation will be eased.

We will find out tomorrow, how accurate the above suggestions will prove to be.

27th June 2022

Chief Minister Fabian Picardo is tomorrow expected to deliver “the toughest budget” since the GSLP/Liberals were elected to government in 2011.

The Gibraltar Parliament convenes at 10.30am on Tuesday for the start of a budget session against the backdrop of public finances devastated by the impact of Covid-19 and slow recovery amid continued Brexit uncertainty, travel disruption, rising inflation and international upheaval caused by the war in Ukraine.

People close to the budget planning process indicated that tomorrow’s session would be “the toughest budget of his time in office”.

The same sources suggested the budget will have to seek ways to increase income to public coffers “from traditional sources of government revenue”, raising the possibility of increases in different taxes and charges for public services.

“There are likely to be very few, if any, giveaways in this year’s budget,” one official said.

The stark nature of this year’s budget session was already flagged earlier this year.

In May, Mr Picardo revealed that the deficit for the last financial year would be £55.3m and that net borrowing had increased to £652m after cash reserves “just shy” of £120m.

Those figures are usually released during the budget debate.

But Mr Picardo said at the time that he had taken the decision to release the deficit figure on the same day he circulated to MPs the 300-page Estimates of Revenue and Expenditure for 2022/23, which sets out in detail his administration’s spending plans for the next 12 months.

The GSD said it had arrived at “a very different analysis” of Gibraltar’s financial performance for 2021/22, insisting the real picture of borrowing was £50m higher once the Covid-19 overspend was factored in.

The budget debate will put a spotlight on long-standing differences between the Government and the Opposition on the GSLP/Liberals’ handling of public finances.

The Gibraltar Government has consistently highlighted the unforeseen impact of the Covid-19 pandemic, not just in terms of the cost of the response but also the impact on revenues in key areas of economic activity such as tourism.

But the Opposition, while acknowledging the effect of Covid-19, insists that the Gibraltar Government has badly managed public spending, racking up debt to record levels including through government companies that make it hard to see the full picture.

The budget session this year comes against the backdrop of the final phase of ongoing negotiations for a UK/EU treaty on the Rock’s future relationship with the bloc.

It comes too just days after the global money laundering watchdog, the Financial Action Task Force, placed Gibraltar on its ‘grey list’, a decision that could have ramifications for companies operating here despite assurances from the Government that the Rock will comply with FATF recommendations within a year.

Unions and local NGOs have also warned of the impact of the rise in the cost of living on lower-paid members of the community.