The Dollar and the Globalist Power Complex: Overcoming ‘Designer-Chaos’ at a Critical Moment for the Human Race

By Julian Rose

October 21, 2024

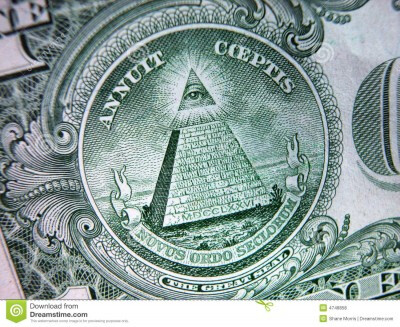

Order Out of Chaos – ‘E Pluribus Unem’– thanks to its being imprinted on the US Dollar bill, is a well known epithet. It is accompanied by a pyramid in whose apex is embedded the all seeing Eye of Horus.

You won’t find a more stark symbol of the ambition of the globalist power complex than this.

But as familiar as it is, it is worth reminding ourselves that this message is so brazenly printed on the bank note of the US currency because that country’s banking empire was designed to lead the take over and domination the world.

With the creation of The Federal Reserve as a public/private banking institution in 1913 came the financial means to fund the US as the new global hegemon, taking over where the British left off.

With the creation of The Federal Reserve as a public/private banking institution in 1913 came the financial means to fund the US as the new global hegemon, taking over where the British left off.

The Rockefeller family encapsulated US elite ambitions to bring into reality a ‘New World Order’ with US power brokers at the helm. Thus the despotic call for ‘Full Spectrum Dominance’.

Once joined up with the European Rothschild’s, a banking superpower was born that financed both the fascist and the ‘allies’ military industrial project, fully exploiting the power of the ‘divide and conquer’ formula during two world wars and beyond.

The objective was to not only get rich from war but also to crush the life out of the broad swathe of humanity whose instincts were essentially peaceful.

In order to be successful, this process – incorporating as it does general population reduction – needed to instil ‘chaos’ into the very foundation of society at a global level.

The instilling of chaos on a global level is a long term affair. It has to eat its way into the heart of relatively stable national institutions; cultures; established socio economic trading patterns; environmental protection; agriculture; the arts; education and of course standard financial practices.

What I think we can safely say is that this process of totally undermining the stability of planetary existence and the basic equilibrium of human life is only now coming into its full expression.

It needed to absorb every nation state of the Western world, of Eastern Europe and Asia and the great majority of Southern hemisphere land masses and peoples, before having the capacity to fully dictate terms on the global stage.

Such unbridled megalomania was encapsulated in the initiative known as The Project for the New American Century, established as a ‘think tank’ in the mid 1990’s, but actually operating as a global policy maker.

The human and collateral damage done since this time has been massive. However the US has bankrupted itself in the process, both economically and psychically. The bottom has fallen out of the world policeman’s beat – with the baton having been taken up by the shadow government hierarchy which is no longer identified with any particular land mass.

The deep state hierarchy was actually ‘in charge’ all along, but the US was chosen to be the front for its ambitions.

The global lockdowns achieved via mass promotion and indoctrination of the Covid scam are the most stark example of this one world dictatorship manoeuvring itself to exert the latest forms of chaos into every corner of the planet.

Chaos, taking the form of war fermentation, is now manifesting in Ukraine, Israel/Palestine, Jordan, Lebanon, Syria and seeks to draw in Iran, Iraq, Egypt, Saudi Arabia and pretty much the whole of the Middle East...

Continues.

With the creation of The Federal Reserve as a public/private banking institution in 1913 came the financial means to fund the US as the new global hegemon, taking over where the British left off.

With the creation of The Federal Reserve as a public/private banking institution in 1913 came the financial means to fund the US as the new global hegemon, taking over where the British left off.